Economists point out that it is not desirable for savings to “lie” in a bank account or under the bed, and that it is more desirable to invest that money.

For many, the first and often the only association with this is starting their own business. However, investing does not mean exclusively starting your own business, there are several investment options. These possibilities are the purchase of investment gold and bonds, which we wrote about earlier, shares and investing in open investment funds.

The need to invest has increased due to rising inflation, i.e. loss of value of money, as well as due to the need to ensure a more certain future. Taking care of a more certain future is all the more necessary because of the questionability of pension insurance – whether it will exist at all and, if it will, whether the pension will be sufficient for a dignified life.

Professor at the Faculty of Economics of the University of Sarajevo (EFSA), Azra Zaimović, at the presentation of the results of the research on financial literacy in Bosnia and Herzegovina, which was conducted by the UNSA Research and Development Center, pointed to the above.

“The investment culture is simply not developed. There are many limiting factors – our capital market is poorly developed. We went through privatization that did not help the development of the capital market. So the capital market was created on the basis of unnatural. There is no perspective of long-term planning. So, what will happen in 10-20 years. We only think about how to live on pension 10 years before retirement, which is very late. This is something that should be thought about in 25-30 years, when we become independent and start making money,” Zaimović pointed out.

At the same time, certain companies enable citizens to invest in open investment funds, and Triglav Fondovi is among these companies.

What are open-end investment funds?

This company manages open investment funds, and for Klix.ba they explained what kind of funds they are.

“Open investment funds are a form of joint investment in which a large number of investors invest their money in investment funds managed by the company Triglav Fondovi. The invested funds of the investors are further invested in securities, such as shares and bonds on world stock exchanges. This enables investors to indirectly participate in the world capital market, even with smaller investment amounts,” they reasoned.

There are three basic types of open-end investment funds: equity, bond, and money market. The key difference between them, as they noted, is in the investment structure and potential investment results for the investors themselves. Namely:

- Equity funds involve investing primarily in company shares. These funds usually offer the opportunity for higher returns, but with higher risk;

- Bond funds involve predominantly investing in bonds, which are safer than stocks, so they enable moderate risk, but also a moderate return;

- Money funds imply investment in short-term instruments and deposits. These are funds with low risk, but also lower yields.

In addition, there may be other types of open-end investment funds or a combination of the previously mentioned as a mixed fund.

Funds on offer

Triglav Fondovi through the Triglav Global stock fund enables investment in the shares of some of the world’s largest companies, such as Nvidia, Microsoft, Apple, Google, Amazon and The Walt Disney Company.

Furthermore, through the Triglav Bond fund, they make it possible to invest in the bonds of some of the most developed countries of the European Union, such as Germany, Belgium, France and Spain. In addition, it is possible to invest in bonds of large financial companies, such as UBS Group AG, BNP Paribas SA and JPMorgan Chase & Co.

It should be recalled that the aforementioned investment opportunities are available to both legal and physical persons. They pointed out who most often invests in which open investment funds.

“Those who want a higher return on investment and prefer long-term investment, predominantly choose the Triglav Global Equity fund for investment. Those who ‘aim’ for a more moderate return in the medium term and want greater stability, choose the Triglav Bond fund. Individual investors, especially legal entities, combine investment in both investment funds in accordance with their preferences in order to simultaneously achieve a higher return through the equity fund, with the moderate stability they achieve through the bond fund,” they stated.

Yield and fear of depreciation

Return or return on investment is profit from investment. So, it is the difference between the initial and current value of the investment. For example, if you invested 100 KM, and the value of the investment later amounts to 110 KM, the return on the investment is 10 percent. Triglav Funds explained what a short-term decrease in value is.

“Short-term reductions in the value of investments are a completely normal and expected phenomenon in the markets. This does not mean that money is lost, but only that its current value varies. Oscillations are an integral part of investing, but in the long term, markets historically show a tendency to grow. Investors who invest regularly and remain consistent with their financial goals and their investment plan, as a rule, achieve positive returns,” they emphasized.

They argued the previous claim with the following facts:

- Due to inflation, money, if not invested, is certainly worth less over time. According to official data from the Agency for Statistics of Bosnia and Herzegovina, the price level in December 2024 compared to the same month of the previous year is 2.2 percent higher. This means that the money, which was just standing on the side, must have lost so much of its value because the same amount of money can buy less. Compared to the average price from 2015, at the end of 2024, total inflation is 27 percent, with food inflation at 50 percent;

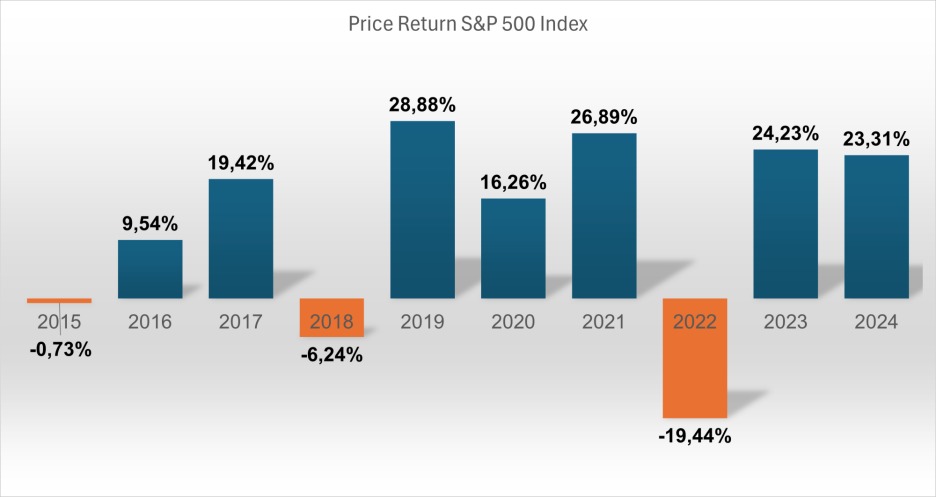

- On the other hand, the average annual return of the S&P500 stock index over the past 10 years, ending at the end of April, is 10.32 percent per year. This means that 10,000 KM invested 10 years ago would be worth 26,702 KM today, representing a growth of 167.02 percent. Although past returns are for informational purposes only and do not represent the possibility or projection of expected returns in the future, they do provide insight into long-term market trends.

How to invest and what are the differences compared to stock market buying

In the following, Triglav Funds referred to the procedure for investing in open investment funds.

“The investment procedure is very simple and, as a rule, it takes 10 minutes for natural persons to fill out the access documentation and make a payment to the account of the selected investment fund. An additional advantage is that in the case of choosing monthly payments through an investment savings plan, the access documentation is submitted at the beginning, and later only payments are made. A special advantage is that the monthly payments do not have to be in the same amount every month,” they stated.

In response to the question of how this type of investment differs from buying bonds and/or shares on the stock market, they pointed out that there are several differences, that is, advantages compared to the independent purchase of shares or bonds, and some of them are:

- The investor does not need prior knowledge of economics or financial management;

- Investment management requires specific knowledge, skills and considerable time, which independent investors usually do not have. Investment funds are managed by experts with experience in monitoring the market, analyzing trends and identifying investment opportunities, on the basis of which they make informed investment decisions;

- By investing any amount, you are investing in the entire portfolio of the investment fund, that is, in all the stocks or bonds held in the investment fund. In contrast, directly purchasing individual stocks or bonds requires more capital to achieve a similar level of diversification;

- By investing in the entire portfolio, diversification is achieved, that is, the risk is reduced in relation to an individual share or bond that the investor would have bought himself;

- Investment funds provide access to global markets, which is often more complex and expensive for individuals to achieve through direct investment.

In addition, as they add, investing through open-ended investment funds enables the investment of smaller financial resources compared to the resources that would be needed for individual investment, while the maximum amount is also not determined, so it is acceptable for all types of investors.

Benefits and risks

They also highlighted what those who invest in open-end investment funds get, as well as the risks of such an investment. They initially listed the benefits.

“The main reason why investors choose to invest in open investment funds is to achieve a yield or return on investment, which is higher than other available forms of savings or investment. By investing in investment funds, which have shares or bonds of global companies, it is possible to easily diversify investments to a large number of companies outside Bosnia and Herzegovina. It is especially important that these funds are an excellent instrument for long-term savings, enabling investors to gradually build financial security,” they stated.

They then listed the risks of investing in open-end investment funds.

“The general recommendation when investing in the capital market is that it should be a long-term investment and that the part of the money that the investor will not need for at least six months to a year should be invested. The reason is that the value of shares, bonds and, consequently, the investment fund may fluctuate over a period of time and be lower than the amount of invested funds. In such situations, it is recommended not to withdraw investments because the real loss occurs only upon payment,” Triglav Fondovi emphasized.

More experienced investors, they add, often use these periods to make additional investments, taking advantage of favorable prices for potentially higher long-term returns.

What is the role of Triglav Funds?

They also explained their role and that of other companies like theirs in the process of investing in open investment funds.

“The role of the company Triglav Fondovi Sarajevo is to actively manage investment funds, creating a portfolio of securities (stocks and bonds), which will provide investors with a long-term stable and satisfactory return. In addition, we receive investment requests from investors, realize investments or payments, and inform investors about the situation on the capital market and the movement of the value of their investment,” they stated.

They mentioned that this year they further improved the service by enabling investors to monitor the value of their investment on a daily basis via the “My Account” online application.

Interest and advice

According to information from Triglav Fonds, there is generally an interest in investing in open investment funds and this interest is increasing. They believe that this is a consequence of the increasing awareness of citizens, as well as their need to invest in new and different forms of investment that can give a higher return in the long term compared to traditional savings.

“The fact that through this type of investment in Triglav Funds, investors’ funds are diversified into global companies is an additional advantage for investors,” they repeated.

They also had advice for those who want to invest in open-end investment funds.

“In general, investing in open-ended investment funds in the long term allows for higher returns on average compared to other forms of savings. At Triglav Fondovi Sarajevo, we enable legal and natural persons to arrange a meeting in order to obtain professional and reliable information, relevant for making an investment decision. In addition to classic meetings, we often have video meetings, which are an excellent way to efficiently inform about investment opportunities,” they pointed out.

The Ultimate Guide to Starting a Profitable Online Business in 2025

The Ultimate Guide to Starting a Profitable Online Business in 2025